Healthcare and pharmaceutical industries have increasingly moved towards treating patients at an individual level, both in terms of patient centricity and personalised medicine. As part of this phenomena there is a growing focus on providing patients greater flexibility on the location and timing of how they receive care.

It is important to stress that this movement is not merely looking to increase at-home delivery of medicines, but instead to introduce structural changes to healthcare systems focusing on treating patients outside of the hospital where possible. Historically, we have already seen successful cases where care has been moved out of the hospital, such as with the advent of dialysis centres and at-home dialysis.

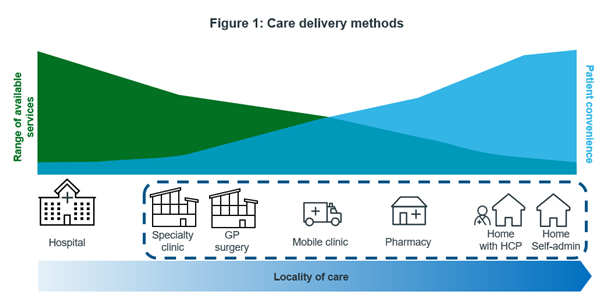

There are range of options, highlighted in figure 1, for where and when care can be administered, including but not limited to:

- Outpatient clinics, which can provide complex treatment but may require patients to travel some distance (although still shorter than traveling to a relatively fewer number of hospitals).

- Mobile clinics, which can travel to more remote/rural patients and still provide complex treatments like an outpatient centre, but at a smaller throughput due to their smaller physical size.

- Local pharmacies, which are more numerous and more local than outpatient clinics, but still require patients to travel and are unlikely to be able to administer treatments more complex than IV formulations.

- At-home treatment, with or without an assisting HCP. At-home treatment is the most convenient option for patients but requires significant investment in logistics and personnel.

These options are not mutually exclusive, and a near-to-home care system can comprise multiple care administration endpoints. Germany already has a near-to-home system in place with the AmbulanteSpezialfachärztliche Versorgung (ASV)system which allows for treatment of complex conditions in clinics and practices without hospital admission. Additionally, in the UK some pharmacies have been transformed into “healthcare centres” which can administer medications as well as testing and screening[1].

This “near-to-home” care trend has also been accelerated by the COVID-19 pandemic, which has simultaneously demonstrated new techniques and technologies as well as imposed significant constraints on healthcare systems globally[2],[3],[4]. One notable example of this is the proliferation of telemedicine and telehealth services. As a result of the pandemic, 81% of healthcare professionals (HCPs) have reported engaging remotely with their patients more often, and 97% say that these technologies can help mitigate the patient backlogs caused by the pandemic[5],[6].

Other indicators also point to the rise in near-to-home care, including greater use of self-administrable formulations. Globally between 2016 and 2021, Humira saw sales of autoinjector formulations grow at 13.5% CAGR whereas sales of subcutaneous vials shrank at 33.4% CAGR. In the same period, European autoinjector sales grew at 18.6% CAGR[7]. Manufacturers are also looking to develop more patient-friendly formulations, such as in the checkpoint inhibitor market where companies are racing to develop a subcutaneous product[8]. Phesgo is another example; combining two pre-existing IV treatments (pertuzumab and trastuzumab) into one subcutaneous product has reduced administration time from 2.5 hours to 5 minutes[9].

Mobile phones and Internet of Things (IoT) devices like smart watches also play a role in near-to-home care. Due to their increased complexity and inclusion of many kinds of sensors these devices can collect vast amounts of health data from users in the form of digital biomarkers[10]. This data can in turn be used by HCPs to aid with monitoring of chronic health conditions, diagnosis and preventative care regimes, whilst minimising the number of in-person visits required.

Digital therapeutics (DTx), which often rely on digital biomarker information from smart devices and tend to be approved for narrow clinical indications, are particularly suited to at-home care. They tend to be heavily skewed towards neurology and psychiatric indications, which comprised two-thirds of all DTx indications in 2021[11]. In September 2020 at the height of the pandemic, Germany passed a law allowing for the reimbursement of DTx, a major step in driving their adoption in the country[12].

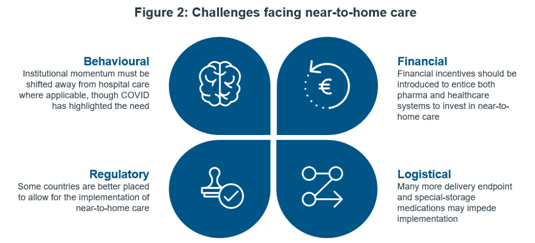

However, this does not mean near-to-home care faces clear sailing, as there are still challenges to be overcome, highlighted in figure 2. Ingrained institutional behaviours and inertia are powerful forces that could hinder changes to business-as-usual, even despite the disruption from COVID-19. This behavioural hesitancy differs from country to country; in the UK, recommendations to make greater use of homecare providers to dispense hospital medicines have been around since 2016[13]. Comparatively in Germany, the prevalence of ASV centres may make further implementation of near-to-home care solutions require extra persuasion.

Financial considerations are also important, such as ensuring that funds are available to promote transformation, and that financial incentives are in place for pharma and wholesalers. Additionally, alongside financial considerations there are regulatory ones; for instance, there must be legal frameworks in place to allow the disbursement of hospital medicines to patient’s homes. Italy currently has no legal framework for the home delivery of drugs. Despite this, some schemes have been implemented by pharma companies, including Alnylam’s AMYCARE programme. However, these schemes involving pharma companies have raised concerns surrounding fair access to medicines. Finally, a shift to near-to-home care brings with it substantially more endpoints involved in the care delivery process and will require a scaling-up of logistics operations involved.\

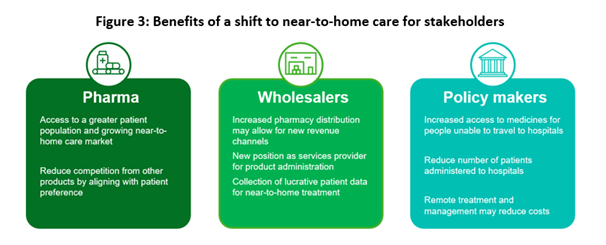

Despite these challenges, there are numerous benefits to be had for all stakeholders involved in a transition to a near-to-home care healthcare model, summarised in figure 3:

- Healthcare systems can drastically reduce their patient backlogs and save costs by reducing the number of patients admitted to hospitals

- Pharma companies gain access to a new patient population and new revenue streams

- Wholesalers may be able to add service provision as a new revenue stream, and can gain access to valuable (anonymised) patient data

- Most importantly, patients receive more convenient care such as a less-stressful treatment pathway and less travel

In order to obtain these benefits, pharma and wholesalers should strongly engage with healthcare policy makers, and actively promote the paradigm shift from hospital treatment to near-to-home treatment where possible.

[1]Selected Lloyds pharmacies to be transformed into ‘healthcare centres’, Community pharmacy news, 05/12/2017. Available at: https://www.chemistanddruggist.co.uk/CD009078/Selected-Lloydspharmacies-to-be-transformed-into-healthcare-centres

[2] Comirnaty, Pfizer’s COVID-19 mRNA vaccine, generated $36.8bn in revenue in 2021: https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2021/performance/

[3]HCPs estimate the backlog of patients in Europe will take at least 3 years to clear (as of December 2021): https://assets.pro.sony.eu/Web/healthcare/smart-imaging-platform/EN-covid-impact-whitepaper.pdf

[4]Globally, COVID-19 vaccine spend is estimated to be $251bn total by 2026: https://www.iqvia.com/insights/the-iqvia-institute/reports/the-global-use-of-medicines-2022

[5]COVID Future perspective in terms of patient management and care – EU4, UK & US, IQVIA

[6]HCPs estimate the backlog of patients in Europe will take at least 3 years to clear (as of December 2021): https://assets.pro.sony.eu/Web/healthcare/smart-imaging-platform/EN-covid-impact-whitepaper.pdf

[7]IQVIA MIDAS Quarterly, MAT Q4 2016 – 2021

[8]https://pharmaphorum.com/news/roche-scores-phase-3-win-for-subcutaneous-tecentriq-eyes-filings/

[9]https://www.bbc.co.uk/news/uk-england-merseyside-56648455

[10] Breaking New Ground with Digital Biomarkers, IQVIA, 04/03/2021. Available at: https://www.iqvia.com/library/white-papers/breaking-new-ground-with-digital-biomarkers

[11]Digital Health Trends 2021, IQVIA Institute, 22/07/2021. Available at: https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/digital-health-trends-2021/iqvia-institute-digital-health-trends-2021.pdf

[12] Digital Health Applications (DiGA), Federal Ministry of Health. Available at: https://www.bundesgesundheitsministerium.de/themen/krankenversicherung/online-ratgeber-krankenversicherung/arznei-heil-und-hilfsmittel/digitale-gesundheitsanwendungen.html

[13] Operational productivity and performance in English NHS acute hospitals: Unwarranted variations, Lord Carter of Coles, February 2016. Available at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/499229/Operational_productivity_A.pdf